Premier PMI helps firm choose best corporate health insurance plan without unnecessary difficulties

Adopting corporate health insurance ought to improve a company's employee value proposition, not SAP countless HR hours negotiating ambiguous choices, conflicting advice, and administrative complexity.

Still, many businesses find choosing and applying health benefits annoyingly challenging. Brokers flood them with confusing options, insurers offer inconsistent information, and the process extends for months as decision-makers try to figure out which solution best serves their workforce.

Partly by doing away with these unneeded problems, Premier PMI has developed its reputation as a leader in business health insurance. Their methodical approach turns what would normally be a difficult, time-consuming job into a simple procedure that generates great results without depleting the internal resources of already overburdened HR staff and company leaders.

Photo credit: Unsplash.

Why the Standard Corporate Insurance Process is So Complex

First, one must ask why the conventional approach presents such great difficulties for businesses in order to appreciate how Premier PMI streamlines corporate health insurance choices.

Information Overflow Without Definite Direction

Dozens of insurers, hundreds of policy configurations, and countless variations in coverage levels, network breadth, pricing models, and administrative systems abound in the UK corporate health insurance market. When companies contact several brokers or insurers directly, they are usually overwhelmed with:

● Extensive proposal papers full of insurance jargon and scientific lingo

● Spreadsheets comparing dozens of features, but hardly any of which really count

● Conflicting advice from several brokers, each claiming their suggestion is the best option

● Marketing materials stressing various features make a sensible comparison almost unachievable.

Decision-makers lack the knowledge to tell real, significant policy differences apart from pointless trivia, which makes them unable to confidently choose the best choice, even if they have a lot of information.

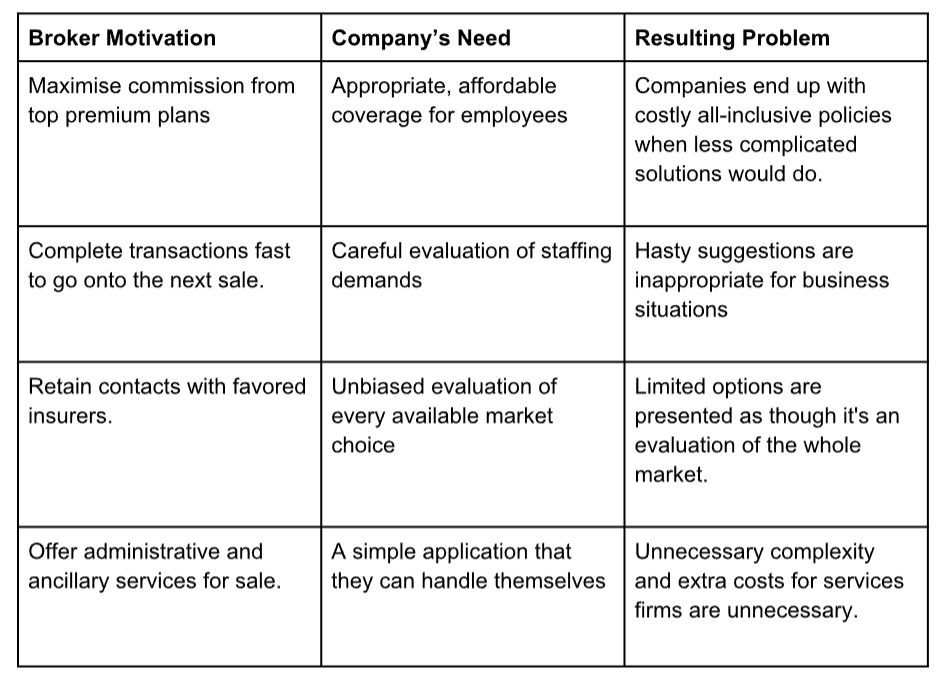

Wrongly Aligned Incentives and Biased Advice

Many corporate insurance brokers work under incentive schemes that conflict with client interests:

How Premier PMI Simplifies Things

Premier PMI has created a systematic approach that tackles every classic pain point, therefore simplifying the selection of corporate health insurance from an exhausting hardship into a simple, easily controlled procedure.

Stage 1: Strategic Needs Survey

Premier PMI starts by thoroughly grasping every business's particular circumstances, goals, and limitations instead of just presenting policy options right away. This first phase of discovery consists of group conversations on:

Needs and demographics of the workforce

● How age distribution influences pricing and insurance coverage needs

● Geographic dispersion and whether national hospital network coverage is justified

● If a company has occupational health data, current health trends will show themselves.

Employee Objective for Health Insurance

● Health insurance business goals

● Recruiting tool to draw talent in cutthroat industries.

Financial limitations and budget parameters

● How health insurance fits into a larger package and overall advantages budget

● readiness to completely pay for coverage as opposed to models requiring worker contribution

● Desire for year-by-year adaptability against a multi-year funding commitment

Usually taking 2-3 hours of group discussion, this thorough evaluation sets the basis for recommendations that really fit the company. Companies get direction created just for their needs rather than a generic solution. This specified solution could involve suggesting top insurers such as WPA Health Insurance and other reputable providers.

Stage 2: Option Creation and Market Research

Premier PMI's experts examine the whole market to find solutions that fit best, armed with a deep awareness of what the company needs:

Complete insurer evaluation: Looking at the business offerings of all the main companies, not only the ones the broker has the closest ties with.

Coverage structuring: Designing 3–4 unique strategies at varied pricing levels, from fundamental to thorough, lets businesses view obvious trade-offs between coverage and cost in coverage structure modelling.

Network adequacy verification: Making sure that suggested insurers in regions where staff members really live offer enough hospital and specialist access.

Administration system assessment: Rating every insurer's HR support systems, employee communication tools, and online platforms.

Using Premier PMI's knowledge of hundreds of business customers, claims handling reputation helps to find which insurers provide the best claims experiences.

Usually, 3–4 clearly different choices with simple explanations of variations, pricing, and trade-offs the result is a succinct comparison of the finest business health insurance policies for the particular firm.

Stage 3: Clear Recommendation with Solid Rationale

Premier PMI offers a clear recommendation of which option they think best suits the interests of the business, together with a thorough justification for this decision, following presentation of possibilities.

The advice covers:

● Why a certain policy structure and insurer fit the unique needs of the business.

● How well the level of coverage matches company goals and workforce requirements

● Why at comparable pricing ranges one choice offers more value than other

● What compromises have been accepted and why these fit this company?

● How ongoing administration and implementation complexity may be under control

This unambiguous direction removes the confusion many businesses encounter when given several apparently identical alternatives. Decision-makers get to know not only what Premier PMI advises but also why it is recommended; therefore they may judge whether the logic matches their own view of corporate goals.

Stage 4: Simplified Implementation Assistance

Premier PMI handles implementation logistics once a choice is decided upon, freeing company HR departments from paperwork stress. Hence, getting the best corporate health insurance plans requires little to no stress. Premier PMI will handle:

Employee communication materials: Well-crafted papers outlining the new benefits in plain, easily understandable language that stresses value as opposed to perplexing workers with insurance jargon.

Managing the enrolment process: Working with the insurance to provide simplified enrolment either via individual consultations, group information sessions, or internet platforms, depending on company preference.

Coordinating medical underwriting: Managing the compilation and submission of health declarations as needed, guaranteeing staff members comprehend the procedure and meet requirements exactly.

Stage 5: Continuous Cooperation and Proactive Administration

The value of Premier PMI goes well beyond the first choice of policies. Their continuous assistance removes the challenges businesses usually encounter in handling corporate health insurance year after year:

Quarterly or bi-annual check-ins: Frequent communication to find out if the policy is working, if staff members are content, and if any changes would improve outcomes.

Rather than relying on particular employees or HR teams to fight insurers alone, claims experience monitoring—tracking whether claims are handled easily and intervening when issues arise—helps to ensure smooth processing of claims.

Employee question assistance: Company HR departments may use this as a starting point for difficult insurance questions they are not qualified to answer.

Proactively handling renewals three to four months before policy expiration, renewal management allows time for a comprehensive market review instead of hurried choices under time pressure.

Premium negotiation: Challenging extreme renewal raises and using market competition to obtain fair prices.