What builds investor confidence in a volatile market?

It’s something that just about anyone already knows about in the crypto-sphere, but crypto has a reputation for being a rollercoaster, and not the fun kind with safety bars and predictable loops.

It’s hard to make predictable investments when it comes to it. Just generally speaking here, prices soar, collapse, and soar again, sometimes in the space of a single afternoon. That alone makes you question whether or not it’s a good idea to even invest in new tokens, right? Well, for anyone looking to invest, it feels less like careful financial planning and more like strapping yourself to a rocket and hoping for the best.

While yes, it sounds like a strange analogy, when it comes to investing in crypto in particular, that’s exactly how it feels. So how do investors actually build confidence in coins when the whole market seems designed to keep them on edge? What is it that these people have? Where is this confidence even coming from?

Photo credit: Unsplash.

Liquidity is Just the First Test

Well, the first thing that gives a coin some credibility is simple: can you actually trade it without losing your shirt in the process? If a coin has low liquidity, even a small buy or sell order can move the price drastically, leaving investors stuck or paying more than they expected. No one wants that kind of drama. But liquidity is like having enough people at a party to make it feel alive, but not so crowded that you can’t move.

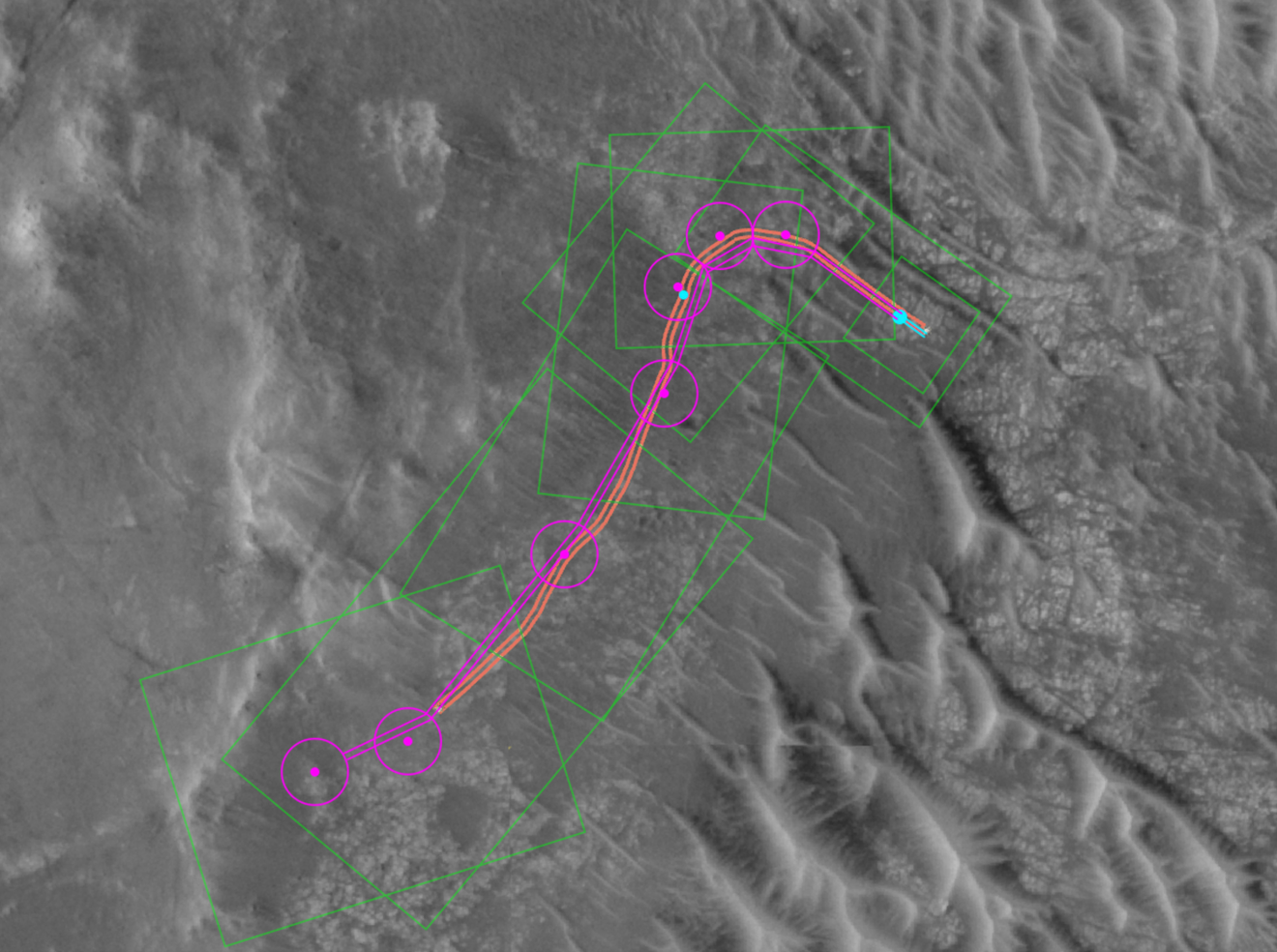

But that’s exactly why crypto market making is so important, because it keeps liquidity flowing by providing constant buy and sell orders, making trading feel smoother and far less chaotic. So, if there’s a smoother flow of trading, the more comfortable investors feel. Simple enough, right?

Transparency Makes People Stick Around

When it comes to transparency in basically anything, it just makes you feel a lot better, right? And yes, confidence doesn’t just come from the ability to trade easily. There needs to be transparency, and of course, investors want to know what’s actually going on behind the curtain.

If a project is cagey about its team, vague about its goals, or hides the fine print, people walk away. Transparency builds trust, and nowadays, it’s a lot easier to see that with tokens, but of course, it’s up to you to learn and understand it (which a lot of people still don’t do).

Consistency Builds Trust Over Time

Just being blunt with this, volatility might be unavoidable in crypto. That’s just how it’s going to be; there’s always going to be bad actors, there’s always going to be less-than-informed investors, there’s always going to be questionable decisions. That can’t be changed at all. But even so, consistency is what makes people believe in a project’s staying power. That doesn’t mean prices need to be stable every day, but it does mean activity needs to be steady.

But really, consistency also helps separate genuine projects from hype-driven coins (that meme coin problem that was already mentioned earlier). Anyone can drum up attention for a week, but it’s the coins that keep showing progress long after the noise dies down that really stand out.